Nicolai Foss: «free environments with low transaction costs are good for entrepreneurship and growth«

Peter Klein: «exercising judgment means taking chances, experimenting, and learning from mistakes«

Much has been written in both academic and practitioner literature on management and entrepreneurship. But according to the view of the two scholars interviewed today by Sintetia, entrepreneurship and the firm have been treated independently, as different subjects. But this shouldn’ be.

Nicolai J. Foss (Professor of Strategy and Organization at the Copenhagen Business School and the Head of Department of the Department of Strategic Management and Globalization at CBS) and Peter G. Klein (Associate Professor of Applied Social Sciences and Director of the McQuinn Center for Entrepreneurial Leadership at the University of Missouri) argue that entrepreneurship and the theory of the firm must belong together, as the firm is the locus of entrepreneurial activity, and one cannot be understood without the other.

Their ideas, developed throughout their prolific academic careers, have been collected and systematized in their 2012 book “Organizing Entrepreneurial Judgment: A New Approach to the Firm”, published by Cambridge University Press. The book is the focus of this interview.

:: The aim of your book is, as you state, to define a program for research in the intersection of the theory of the firm and entrepreneurship. What is wrong with current theory in these fields?

Klein: Until the 1980s, the economic theory of the firm was a branch of neoclassical production theory. “Firms” were highly stylized, abstract units that convert inputs into output – everything economically relevant about the firm could be expressed as a production function. There was little interest in why firms exist, how firms are governed and managed, why some firms perform better than others, and so on. Any behaviors not consistent with “perfect competition” were regarded as efforts to exploit monopoly power. Basically, the theory had little to do with business firms as they actually exist.

Things got better with the emergence of agency theory, transaction cost economics, and the economic analysis of property rights. Even these approaches, however, are fairly static and “closed,” with little room for entrepreneurship and uncertainty. There was a standalone academic discipline of entrepreneurial studies, but it was mainly descriptive and focused on startup companies and self-employed individuals. Even today, the theory of firm doesn’t incorporate entrepreneurs, and much of entrepreneurship theory abstracts from the firms that entrepreneurs establish and operate.

:: What are those «neglected insights» you want to revitalize?

Foss: In this book we pick up on a number of themes associated with less conventional thinkers in economics, notably Frank Knight and his seminal book, Risk, Uncertainty and Profit from 1921. In fact, our book may well be described as “Knightian.” What we appreciate in Knight is his emphasis on uncertainty rather than risk as characteristic of most business decisions and not just the major ones. Someone has to shoulder the uncertainty (it is uninsurable) associated with setting up an enterprise and because these ideas are often not fully or clearly articulable, the result is that entrepreneurs set up firms, bearing responsibility for any profits or losses the venture make. However, Knight’s ideas go much beyond start-ups.

Another source of inspiration is the Austrian school of economics. In the book we put much emphasis on resource heterogeneity and all the many problems of measuring, monitoring, combining, coordinating and so on that arise in a world of heterogeneity. All management problems are caused by such heterogeneity in conjunction with uncertainty. This is something mainstream economics still has to embrace.

:: One of the features one finds of the current literature on entrepreneurship is what you call the «start-up bias», i.e. the almost exclusive focus of researchers, both in theory and empirical work, on new firm formation, small and high-growth firms. Steve Blank might be one of the examples of this bias, defining a start-up as “a temporary organization designed to search for a repeatable and scalable business model”…which obviously seems to differ from an established and mature business. Why do you find this view disturbing?

Klein: Starting new companies is an important manifestation of entrepreneurial action. But conceiving entrepreneurship exclusively in terms of start-ups is too narrow. In the book we distinguish “occupational” and “structural” concepts of entrepreneurship from “functional” ones. An occupational approach defines entrepreneurship as self-employment – hence entrepreneur is an occupation, just like doctor, teacher, lawyer, manager, or taxi driver. Structural approaches treat entrepreneurship as a kind of firm structure, namely new firms, small firms, or high-growth firms. We have no objection to the careful study of self-employment and start-up companies. But we conceive entrepreneurship much more broadly, as a generalized economic function – namely judgmental decision making under uncertainty. Most of the classic contributions to entrepreneurship theory are also “functional” in this sense – Joseph Schumpeter defined entrepreneurship as the creation of new things (not just firms), Israel Kirzner described entrepreneurship as the discovery of previously unknown profit opportunities, and Frank Knight (who we follow) focused on entrepreneurship as uncertainty bearing.

The problem with an exclusive emphasis on start-ups is that a great deal of creation, discovery, and judgment takes place in mature, large, and stable companies. Entrepreneurship is manifest in many forms and had many important antecedents and consequences, and we miss many of those if we look only at start-up companies.

:: Another bias on the literature you highlight and are critical of is «the opportunity-discovery bias». A good deal of research on management and entrepreneurship (e.g. Kirzner) has focused on how business opportunities are discovered and exploited, as if opportunities existed objectively out there. You claim this view is not particularly useful and offer an alternative…

Klein: Much of the practitioner literature focuses on start-ups, but Kirzner’s idea of entrepreneurship as discovery has been hugely influential in the academic literature, particularly through the influence of Scott Shane. We appreciate Kirzner’s challenge to the neoclassical economist’s notion that all human behavior can be expressed as “rational,” maximizing behavior, but we think the discovery metaphor is misleading. In our view, the opportunity-discovery approach makes the entrepreneur a passive player, scanning the landscape for opportunities that already exist but for some reason have not been noticed already. Some scholars have pushed back against this construct by arguing that some opportunities should be regarded as “created,” not discovered. We also think entrepreneurs are creative, but what they create is not abstract “opportunities,” but concrete things like firms, products, business plans, and the like. In other words, the unit of analysis shouldn’t be the opportunity – a metaphor that only makes sense ex post, after profits and losses from a venture are realized – but the actions that entrepreneurs take, ex ante, to establish and operate ventures in hopes of profits in the future.

Foss: I agree with this. However, more is at stake than “opportunity” only really being meaningful as an ex post construct. It seems that the entrepreneurship literature has almost obsessed about the “discovery” aspects of entrepreneurship, that is, the initial phases of the entrepreneurial process. It is entirely OK to analyze how entrepreneurs form ideas and expectations, and indeed such ideas can be units of analysis. However, this is only the beginning. As Peter Klein says it is really key to include the actions, investments and resources that are dedicated to realizing entrepreneurial ideas. Unfortunately, this so-called “exploitation phase” has received less attention than the “discovery” of “opportunities.” This is very lop-sided. The real challenges may lie here. Moreover, as Saras Sarasvathy’s research suggests, those initial entrepreneurial ideas often get changed, sometimes radically so, as a result of trying to make them come alive in the market place.

Foss: I agree with this. However, more is at stake than “opportunity” only really being meaningful as an ex post construct. It seems that the entrepreneurship literature has almost obsessed about the “discovery” aspects of entrepreneurship, that is, the initial phases of the entrepreneurial process. It is entirely OK to analyze how entrepreneurs form ideas and expectations, and indeed such ideas can be units of analysis. However, this is only the beginning. As Peter Klein says it is really key to include the actions, investments and resources that are dedicated to realizing entrepreneurial ideas. Unfortunately, this so-called “exploitation phase” has received less attention than the “discovery” of “opportunities.” This is very lop-sided. The real challenges may lie here. Moreover, as Saras Sarasvathy’s research suggests, those initial entrepreneurial ideas often get changed, sometimes radically so, as a result of trying to make them come alive in the market place.

:: In the book you are also critical of some of the empirical work it is done in these fields. Focusing on the relationship between entrepreneurship and macro phenomena, like growth… One finds very rough proxy variables to measure entrepreneurship such as self-employment, business ownership rates or new business formation. What guidelines for conducting empirical quantitative work follow from your approach?

Foss: In fact, research has rather consistently shown a relation between growth and entrepreneurship, even if narrowly conceived of as start-ups or self-employment. It is indeed true that the proxies are crude, although things are getting better internationally. However, the main problem is that a whole category of entrepreneurship is excluded from the statistical work – namely, the entrepreneurial activities carried out by established firms. Established firms also set up new ventures, form new bold ideas, dedicate resources to these and so on. Moreover, they find new ways to combine resources. These are often very incremental, but it all adds up. It stands to reason to getting the entrepreneurship of established firms into the databases will give us a much improved understanding of the growth process.

:: You make the point that «problem-solving activities in firms have many of the features of experimental activity«. This view radically contrasts with the typical microeconomics textbook view whereby firms face a simple optimization problem (maximizing profits subject to known constraints)….

Foss: True. But economics simply has to accommodate the fact that the choice of production methods, the combination of resources, the sourcing of knowledge and so on are not “data”.Hayek was very explicit about this in a brilliant essay from 1948 (“The meaning of competition”). Firms may be groping towards optimum resource combinations, but they are really tracking a moving target, because of shocks to technology, tastes, policies, and so on. And to the extent that they succeed in tracking the target it is because of sound managerial judgment. I must say, though, that I see many of the younger applied microeconomists, such as Nick Bloom and John van Reenen, adopting this basic view. They need to make sense out of the managerial function.

:: You have a very interesting chapter on internal organization and intrapreneurship (entrepreneurship within firms), where you disagree with the trendy claim in the tech start-up world «that authority and traditional firm organization are fading under the impact of delegation of decision rights to entrepreneurial employees who control critical knowledge.» Why?

Foss: Well, the “trendy claim”, as you call it, has some truth to it. There is evidence of increased delegation, particularly in fast moving industries, and it is also evident that there is a tendency to shift decision rights to employees that are high in human capital. Some of my empirical work with my CBS colleague Keld Laursen speaks to this issue. However, authority has efficiency advantages that just don’t disappear like that. First, authority economizes on the costs of transmitting knowledge: Rather than telling someone why he should carry out a task, how it fits into the big picture, and so on, the holder of authority simply tells someone to get it done. Second, bosses often have superior knowledge, in which case they should give direction. Third, there is a need for someone to operate and maintain reward systems.

:: When dealing with whether a narrow business strategy may be better for the firm, you write (p. 212): «The analysis suggests that more innovative firms will have a narrower scope of business activities than less innovative firms.» This sentence might apply to the focused strategy of Apple, but not so much to the strategy of Google, while the latter is highly innovative and creative. What is your take on this particular case?

Klein: Innovation is a complex and fascinating subject and there is no single path to success. The sentence quoted above comes from a longer discussion of the pros and cons of different innovation strategies. A major benefit of a focused approach is that the firm can promise employees that if they work hard on developing a particular product or service, the firm is very likely to fund it and bring it to market. With a strong identity and clear mission and strategy, everyone is on the same page – “Our company is known for X, and good extensions and developments of X will be supported by the head office.” This can be a good way of encouraging “entrepreneurial” behavior among employees. It certainly seems to describe Apple, which is not necessarily focused in the product space – hardware, software, streaming media, etc. are distinct, complementary products – but has a strong identity in terms of design, pricing, marketing, and the overall customer experience. However, with a focused innovation strategy, a firm may miss out on other potentially valuable activities that don’t fall within the established scope. So there’s a trade-off: focus makes it easier to commit to supporting employee’s projects and initiatives, but also puts all the eggs in one basket. Google seems to think the latter outweighs the former.

:: Defending the role of (properly understood) authority within firms and the need for centralized coordination, you write, «the decentralized solution performs poorly if urgency is important.» Does that claim also translate to the management of macro emergency situations (e.g. natural disasters, financial/banking panic)?

Foss: It is true that the state or some other instrument of collective action tends to step in in such situations. However, I strongly believe that the dominant view that emergency situations must inherently give rise to massive market failure is misguided. The role of markets in coping with macro emergency situations is, however, something we know relatively little about, although much of macroeconomic policy-making is of course predicated on a market failure view.

Klein: I agree. Organizational design is always about weighing alternatives, none of which is “optimal.” At the level of a firm, the advantages of centralization in “urgent” situations typically outweigh the costs. But I don’t think the argument scales up very far. In the case of a city, region, or country, the central coordinator lacks specific knowledge, appropriate incentives, and ex post accountability, which likely makes centralization a cure worse than the disease. Certainly the US government’s reaction to the 2008 financial crisis, which made a bad situation worse, does not inspire confidence.

:: What can economic theory teach us on how to determine the optimal financial structure of firms?

Klein: At best economic theory can help entrepreneurs identify tradeoffs, e.g., between debt and equity, concentrated and dispersed ownership, internal capital markets and arms-length finance, etc. As with organizational structure, no financial structure is “optimal”; we are always choosing among imperfect alternatives. I should add that modern corporate finance has begun to take organizational issues more seriously, though there is still a lot of research (and teaching and outreach) that treats management and governance as a black box.

:: Does monetary policy have an important impact on this in general, and the Fed policies of the recent decade and current days in particular?

Klein: Monetary policy does have some important microeconomic consequences. Low interest rates, and “easy-money” policies more generally, tend to distort entrepreneurial incentives. As emphasized in the “Austrian” business-cycle theories of Mises and Hayek, monetary stimulus encourages entrepreneurs to invest in capital-intensive, long-term production processes, even if these wouldn’t be chosen under normal conditions. Expansionary monetary policy also introduces “noise” into the price mechanisms – prices not only rise on average, but relative prices change more frequently and less predictably – which increases the cost of contracting and makes firms more likely to internalize activities they would have otherwise procured on the market. Finally, both monetary and fiscal stimulus, along with bailouts and other subsidies, reward unsuccessful entrepreneurs at the expense of successful ones, to the detriment of the economy as a whole. (Our 2009 article in Strategic Organization, with Rajshree Agarwal and Jay Barney, elaborates on these points.)

:: What lessons can your approach teach long-term equity investors (e.g. on how to identify sustainable competitive advantages (‘moats’) or other issues related to the importance of the management team)?

Klein: Successful entrepreneurial judgment is difficult to identify ex ante – otherwise it wouldn’t be entrepreneurial judgment! Our approach suggests that quantitative, predictive models are unlikely to be successful in the long run; investors should rely on their own, specific understanding of particular firms and markets, and trust their gut instincts.

Foss: I agree that our approach does not allow for the formulation of clear decision-rules here. However, I think there are some valid key characteristics of successful entrepreneurs, identified by previous research. For example, confidence does seem to be an important factor. So does certain kinds of experience. Successful entrepreneurs also seem to be good at multitasking. So, although successful entrepreneurial judgment cannot be identified ex ante, it is still possible to be more specific about the individuals who are likely to exercise successful entrepreneurial judgment.

:: Which are the most important insights an entrepreneur or manager should learn from your book? For instance, when confronted with whether he should sell his firm or not… or growing his firm through acquisitions?

Klein: In general, exercising judgment means taking chances, experimenting, and learning from mistakes. Second, as noted above, we encourage entrepreneurs to go with their instincts, and not spend too much time listening to the “experts” (even us!). Third, entrepreneurship takes not only great ideas, but also resources, including risk capital, so founders and managers should treat input providers – especially funders – with respect. Regarding specific questions like ownership changes, the make-or-buy decision, growth through acquisitions, etc., we urge decision-makers to think about how entrepreneurial judgment is distributed throughout a firm or economic system. Decision rights should be placed in the hands of those with better judgment, which implies a system where assets change hands, and contracts are written, to align ownership and judgment as circumstances require.

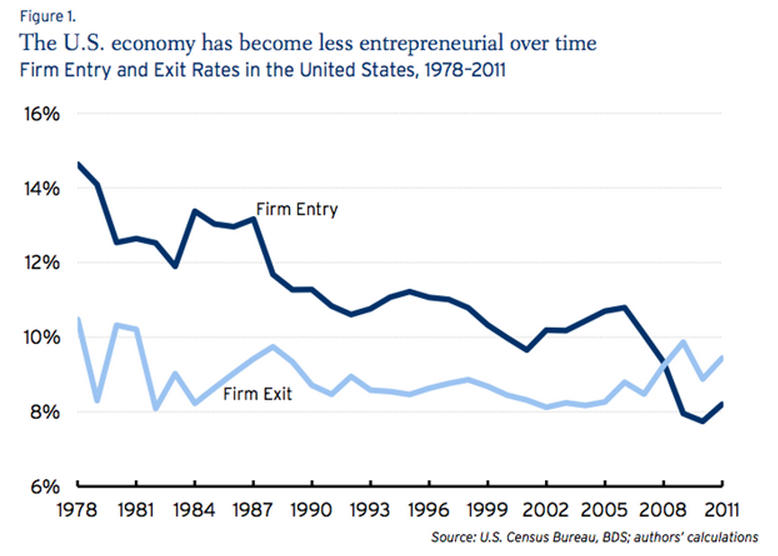

:: A recent report argues that business dynamism is in decline in the US, even in high-tech. What is your view on this? Which region do you think is now the most dynamic and why?

Klein: We don’t favor dynamism per se, but economic freedom. What entrepreneurs need is an environment in which they can experiment and learn, and that requires property rights, the rule of law, sound money, and free and open competition. Government attempts to stimulate entrepreneurship through targeted subsidies, infrastructure spending, tax and regulatory codes that favor one type of firm or location over another, and other attempts to create geographic or industrial clusters of innovation are not likely to be successful. So, to answer your questions, those US states that score the highest on the standard economic freedom indexes are the most favorable to entrepreneurship, other things equal. But of course you already have successful clusters in places like California and Massachusetts, which fare poorly in terms of economic freedom. We think the success of these clusters is despite, not because of, state-level policies

Foss: Some of my cross-country work on entrepreneurship with Christian Bjørnskov speaks directly to these issues. For example, in a paper in Public Choice (2008) we indeed find that sound money and less government meddling with the economy are conducive to entrepreneurship (narrowly defined as start-up activity). In another paper (Strategic Entrepreneurship Journal; 2013), we find that entrepreneurship is highly conducive to productivity advances and economic growth. Jointly these findings indeed suggest that free environments with low transaction costs are good for entrepreneurship and growth across the nations we consider.

1 Comentario

Amazing article, thanks a lot !!